How to obtain a real estate transaction certificate.. step by step

General Manager 25 May 2022

The Real Estate Registration Authority in Egypt issued a decision to end the procedures for obtaining the disposal certificate within 72 hours from the time of submitting the application, and the possibility of shortening the period to about 48 hours, instead of 15 days, to facilitate the citizens benefiting from the presidential initiative for real estate financing with an interest of 3%, which is among the papers. which the bank requires from citizens as collateral for its approval of financing.

Conditions for obtaining a real estate certificate and benefiting from the 3% initiative

Be registered in the real estate registry

The unit is fully finished

The unit data shall be free of irregularities or problems

- Go to the Real Estate Registration and Documentation Department, and request the service of obtaining a real estate certificate.

What is a real estate transaction certificate? And its importance for getting the 3% initiative

The real estate certificate is like a birth certificate for the inquired property

- The real estate certificate shows all the transactions that took place on the property for a period of 10 years prior to the date of the submitted query.

- The real estate certificate shows its previous owners and if there are violations on the property or not.

- The real estate certificate indicates if the property is mortgaged and in dispute or not.

Steps to obtain a real estate certificate to benefit from the 3% initiative

- A copy of the national ID card.

- Go to the Real Estate Tax Authority in the governorate to which the property belongs, to obtain an answer from it confirming whether the property is subject to a tax violation or not.

Fill out the application form for obtaining a real estate certificate through the website of the Real Estate Registration and Documentation Authority.

Fill out the form and submit the applicant's data.

- The data includes the full name, the national number, the phone number, the e-mail, the governorate and the address of receiving the application.

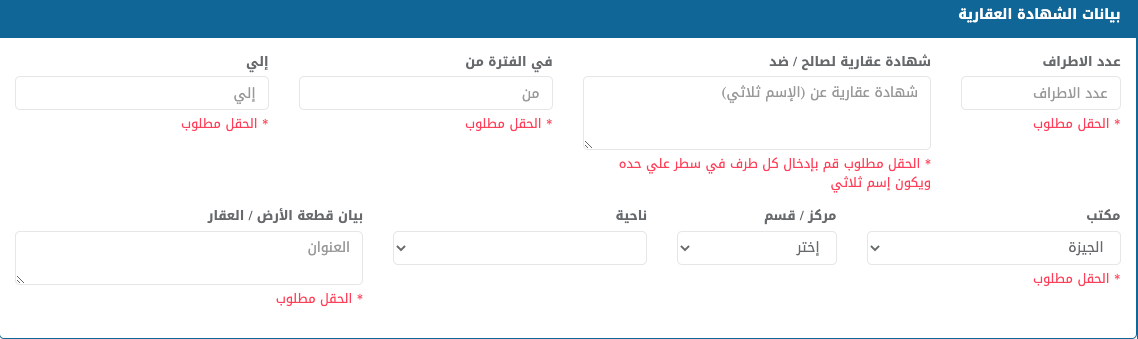

It is necessary to enter the data of the real estate certificate, which is the number of parties, a real estate certificate for or against, the time period, the governorate, the department, the district and the address of the property in detail.

Enter the number of copies to be requested and choose the electronic payment method, whether by Visa or MasterCard, with acknowledgment that the data entered is correct.

The Real Estate Disposition Certificate, or Form 19 as it is sometimes called, is a guarantee for individuals coming to purchase a unit or property; Where it protects them from fraud and deception attempts.

What are the costs of obtaining a real estate disposal certificate?

The fees for obtaining a real estate transaction certificate are 2.5 pounds if it is obtained on time, and 5 pounds if it is quickly obtained. Any citizen can obtain a real estate certificate after following the above-mentioned steps.

What about real estate tax?

It is a tax collected after the sale of residential and administrative units and land, where the seller or whoever transferred the ownership to another person with a contract that was registered after May 19, 2013, pays this tax, which is estimated at 2.5% of the value of the unit.

As for those who made a sale before the date of May 19, 2013, they are charged according to the segments determined by the Real Estate Tax Authority earlier, which are

The first bracket: The value of the real estate tax is 1500 pounds, if the value of the contract reaches 250,000 pounds.

The second bracket: The value of the real estate tax is 2000 pounds, if the value of the contract is more than 250,000 pounds and up to 500,000 pounds.

The third bracket: The value of the real estate transaction tax is 3000 pounds, if the value of the contract is more than 500,000 pounds and up to one million pounds.

The fourth bracket: The value of the real estate transaction tax is 4000 pounds, if the value of the contract is more than one million pounds.

It is noteworthy that the value of this tax is currently paid to the Egyptian Tax Authority within a maximum of 30 days from the date of selling the unit; So that the seller is not charged a late fine.

What is the difference between real estate disposal tax and real estate disposal certificate?

Real estate tax is a tax imposed by the Tax Authority on whoever sells a residential or commercial unit or land outside the boundaries of villages, as it is collected in accordance with the provisions of the law, and it has no income from connecting utilities to real estate.

As for the real estate disposal certificate, it is extracted and used to register the housing units in the real estate registry, and it is not related to the real estate disposal tax in any way.

Categories exempt from real estate tax

Article 42 of the Income Tax Law No. 91 of 2005 mentioned the categories that are exempt from paying real estate tax, which are:

Units and real estate in villages

Real estate presented as an in-kind share in the capital of joint stock companies, but it is stipulated that the corresponding shares shall not be disposed of for a period of five years.

Grant contracts between assets and branches.

Expropriation for the public benefit or for improvement and forced sale

Grants to the government, local administration units, public benefit projects, or donations.

Determining a usufruct right over the property or leasing it for a period of less than fifty years.

The heirs’ disposal of real estate (until the issuance of Law No. 158 of 2018 amending Law No. 91 of 2005, amending Article 42, including canceling this type of exemption).